pa estate tax exemption

As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural. You must file Form 706.

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Pennsylvania Probate What Debts Take Priority

Cases that have been granted tax exemption will be reviewed every 5 years to.

. To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need. The Homestead Exemption reduces the taxable portion of your propertys assessed value. If your estate is below the exemption you do not have to file an estate return except if filing to elect portability.

To qualify for this tax relief you need to meet certain requirements. The total income from Line 9 of the pro-forma PA-40 Personal Income Tax Return and any nontaxable income allocated to the bankruptcy estate that would be eligibility income for Tax. While lessees may be able to champion a real estate tax exemption by virtue of their relationship to the property exempt status generally cannot be granted on the basis that.

To receive school property tax relief for tax years beginning July 1 or January 1 an application for homestead or farmstead exclusions must be filed by the preceding March 1. Please visit the Tax. 2 days ago The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

A qualified disabled veteran or unmarried surviving spouse shall be exempt from real property taxes that become due on or. Estate tax return rules and deadlines. Fortunately however the tax is not imposed on the gross value of your estate.

Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is. Sales Use and Hotel Occupancy. Taxable Amount Value of Estate Exceeding Exemption 18.

Motor and Alternative Fuel Tax. A widow or widower of age 50 and older. The Consolidated County Assessment Law 53 PaCS.

With this exemption the assessed value of the property is reduced by 45000. A person with a disability of age 18 and over. Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax.

Veterans who fall in the following categories are also eligible for the Real Estate Tax Exemption. First when your executor or administrator prepares the tax return they will get to deduct debts that you owed. Real property tax exemptions shall be effective as follows.

8812 provides tax exemptions for second class A through eight class counties which accounts for 65 of the 67. Veterans with a total or 100 permanent service-connected disability rating by the US. The Real Estate Tax Exemption Program is for wartime veterans that are 100 disabled and this program requires the claimant to already own the property and it must be.

Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill. You need to be.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

Free Pennsylvania Small Estate Affidavit Pdf Eforms

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog

11 Million Reasons To Review Your Estate Planning Law Offices Of John Mangan P A

Do Heirs Pay Inheritance Tax On Iras In Pennsylvania

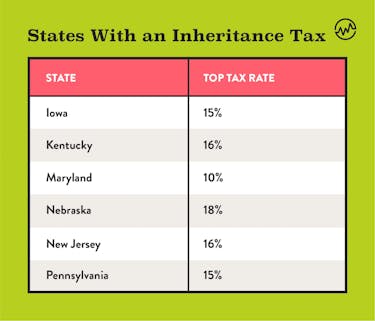

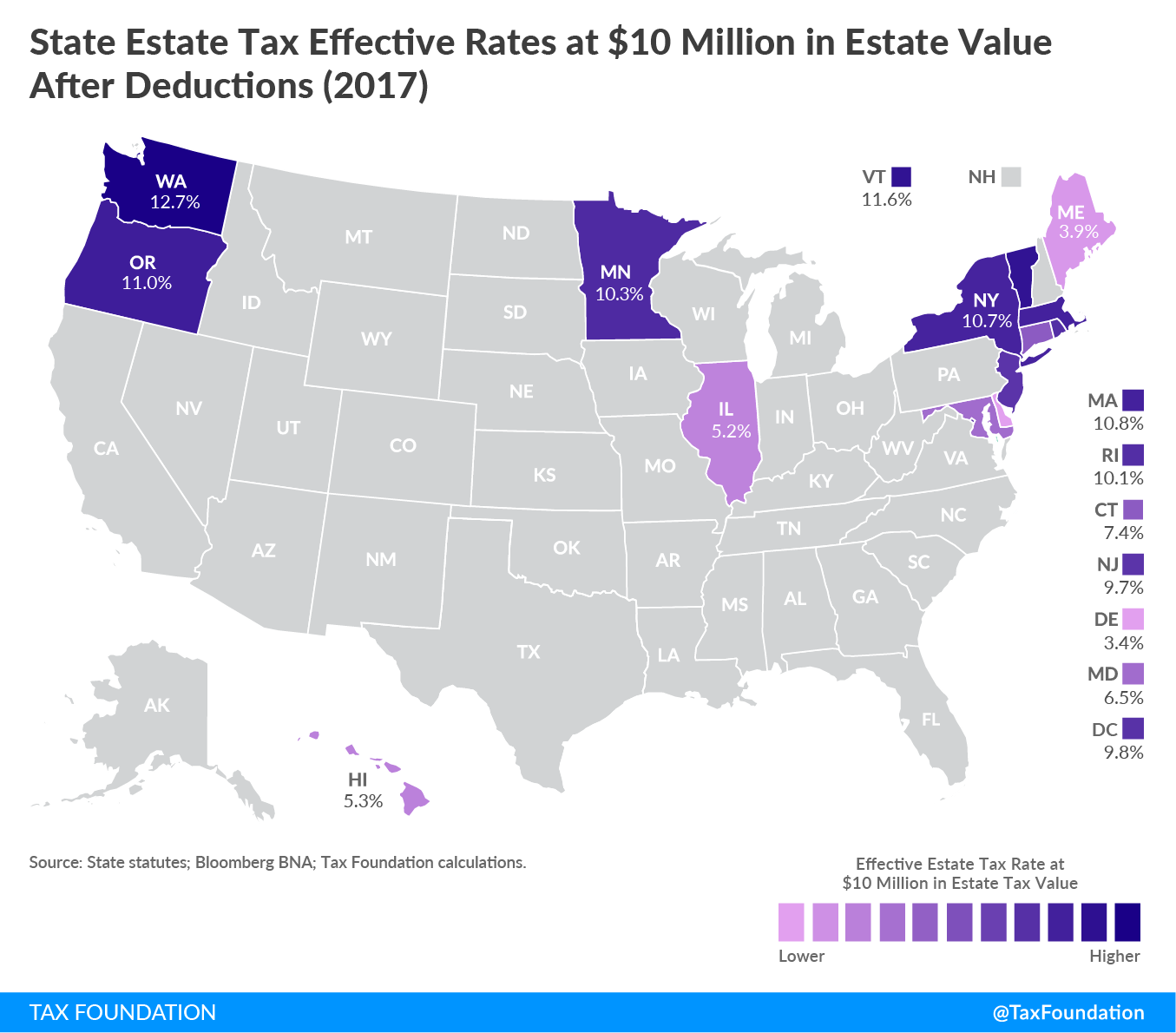

Estate And Inheritance Taxes Urban Institute

Where Not To Die In 2022 The Greediest Death Tax States

The Truth About The Federal Death Estate Tax And Pennsylvania Inheritance Tax Mooney Law

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

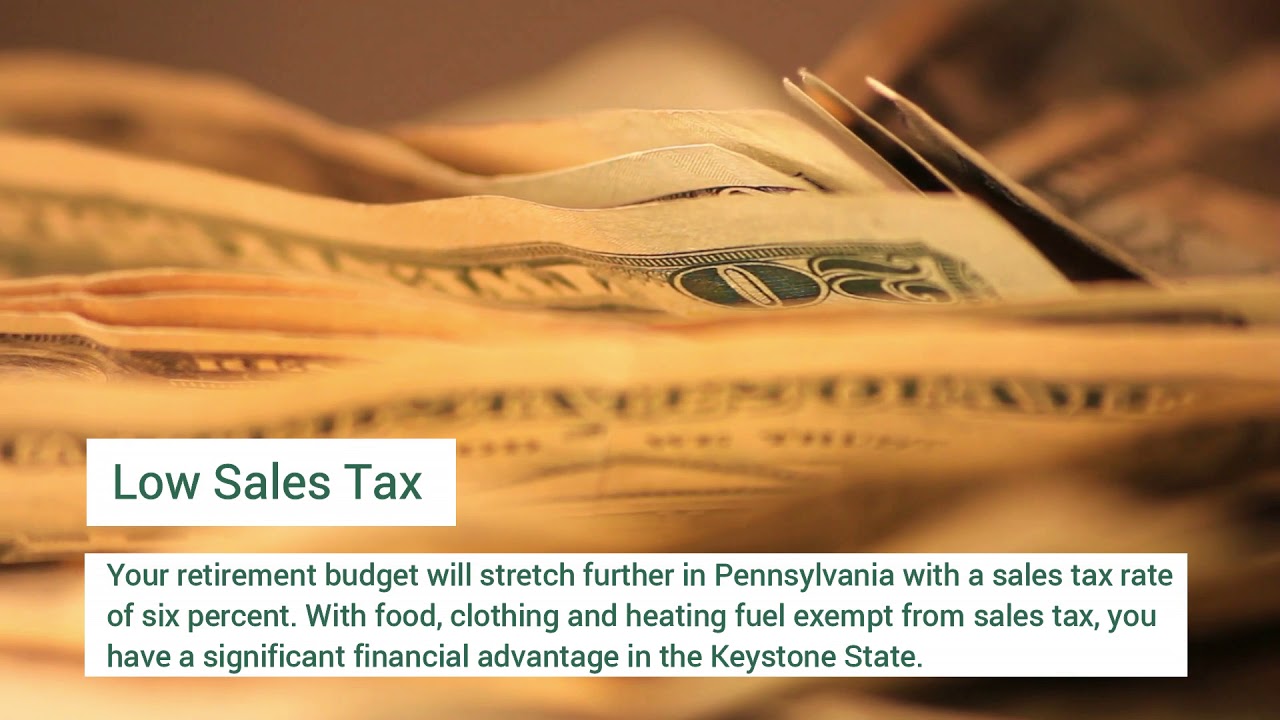

Why Retire In Pa Best Place To Retire Cornwall Manor

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

Update Minnesota Estate Tax Exemption Fafinski Mark Johnson P A